Introduction: Why Tokenization Matters Now

Imagine being able to sell 10% of your home to raise cash without giving up full ownership, or offering investors a share of your painting without physically parting with it. Picture issuing bonds digitally, where coupon payments reach investors automatically through code. This isn’t science fiction—it’s the world of real-world asset tokenization.

Global institutions like the Bank for International Settlements (BIS) and the World Economic Forum (WEF) call tokenization a major shift in finance. Real estate, art, and bonds are already being issued on blockchains by firms such as Deloitte’s real estate pilots and BlackRock’s $1B tokenized liquidity fund milestone in 2025. Yet while the headlines often focus on big banks, individuals, entrepreneurs, and students can also take part.

This article is your step-by-step playbook. I’ll walk you through how tokenization works, what it means for your house, your art, and your bonds, and—just as importantly—where the risks lie.

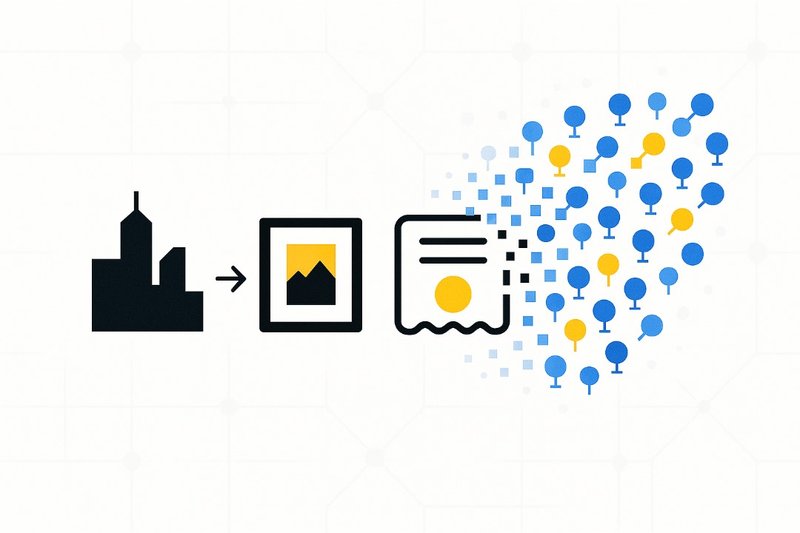

What Does Tokenization Really Mean?

At its core, tokenization is the process of representing ownership rights in a digital token on a blockchain. Each token corresponds to a real claim:

- A fraction of a house

- A share of a painting

- A bond coupon or redemption right

Unlike traditional ledgers hidden in filing cabinets, blockchain ledgers are programmable. They can distribute rent, enforce royalties, or pay coupons automatically. That’s why BIS describes tokenization as one of the building blocks of the next generation financial system.

How Tokenization Works in Practice

Think of tokenization as a six-step journey:

- Asset preparation: Ensure ownership is clean and documented.

- Legal wrapper: Place the asset inside a structure (like an SPV or trust).

- Token design: Define rights—ownership, dividends, or royalties.

- Issuance: Mint tokens with smart contracts.

- Distribution: Sell to investors under KYC/AML checks.

- Lifecycle management: Handle payouts, reports, and secondary trades.

Smart contracts act as digital administrators. For example, instead of hiring an agent to process monthly rent, a smart contract can automatically distribute it to token holders on the first of each month.

Tokenizing Your House: A Practical Guide

When Tokenization Makes Sense

- Rental properties seeking multiple investors

- Co-owned homes where fractional rights are easier to trade

- Development projects looking for broad participation

Step-by-Step Path

- Check your title: Confirm clean ownership; resolve mortgages or liens.

- Set up a legal wrapper: Typically, an SPV owns the house, and tokens represent shares in that SPV.

- Valuation & documents: Commission an independent appraisal and gather property records.

- Design the tokens: Decide supply (e.g., 100,000 tokens), transfer rules, and investor rights.

- Compliance: Run KYC/AML; prepare offering disclosures.

- Launch & distribute: Issue tokens to verified buyers.

- Manage operations: Rent is collected by the SPV and distributed automatically.

- Plan exits: Resale on secondary markets or redemption when the property is sold.

Common Mistakes to Avoid

- Believing tokens guarantee instant liquidity

- Overlooking tax and property laws in your jurisdiction

- Poor investor communication after issuance

Tokenizing Your Art: From Canvas to Code

Foundations First

- Provenance: Verify authenticity, history, and ownership rights.

- IP rights: Who controls reproduction or licensing?

- Custody & insurance: Ensure safe storage and inspection rights.

Two Main Models

- Fractional ownership: Tokens represent shares in the artwork.

- Royalty rights: Tokens give holders a percentage of sales or licensing income.

Why Tokenization Fits Art

Artists and collectors can benefit from programmable royalties. Imagine coding a rule so every future resale automatically pays 5% back to the original artist. That’s power the traditional art market rarely delivers.

Tokenizing Bonds: Debt Goes Digital

What Tokenized Bonds Are

They are traditional bonds—debt instruments—issued and traded on blockchain platforms. The difference? Coupons and redemptions are automated by smart contracts, reducing admin and settlement delays.

Issuance Flow

- Define bond terms (fixed or floating, secured or unsecured).

- Draft legal documents (term sheet, offering circular).

- Set up registrar and smart contract in sync.

- Distribute to eligible investors.

- Automate coupon payments and redemption.

Who Should Consider Tokenized Bonds

- Treasurers seeking faster settlement and transparent servicing

- Projects needing smaller ticket sizes and broader investor reach

Navigating Regulations Without Jargon

Every jurisdiction asks the same five questions:

- What exactly does the token represent?

- Who is accountable if things go wrong?

- Which investors are allowed to buy?

- How are AML/KYC checks done?

- How will taxes be reported?

Snapshot Across Regions

- United States: Tokenized assets often fall under securities laws. Expect disclosure and investor restrictions.

- European Union: Prospectus and consumer protections apply; new crypto-asset frameworks are emerging.

- United Kingdom: Focus on financial promotions, AML, and clear disclosures.

- Singapore: Licensing for capital market services, with regulatory sandboxes available.

A simple rule of thumb: if it feels like an investment, assume securities laws apply until proven otherwise.

Choosing the Right Tokenization Platform

Here’s a quick framework when comparing providers:

- Custody: Who safeguards the underlying asset?

- Compliance: Built-in KYC/AML and wallet whitelisting?

- Chain choice: Public, permissioned, or hybrid?

- Programmability: Can it handle payouts and governance?

- Security: Independent audits and upgrade paths?

- Fees: Transparent setup and ongoing costs?

- Liquidity: Is there a compliant secondary marketplace?

- Reporting: Easy exports for regulators and tax filings?

Myths vs. Realities

- Myth: Tokenization guarantees liquidity.

Reality: Liquidity depends on demand, not technology. - Myth: Smart contracts replace lawyers.

Reality: They enforce terms; they don’t create them. - Myth: Anyone can invest.

Reality: Most offerings have restrictions to protect investors.

Quick Checklists

Real Estate

- Clean title verified

- SPV formed

- Independent valuation

- Offering documents prepared

- KYC/AML completed

- Smart contract deployed

- Secondary trading policy set

- Tax obligations clarified

Art

- Provenance confirmed

- IP rights secured

- Custody and insurance arranged

- Token model chosen

- Disclosures drafted

- Smart contract minted

- Marketplace rules set

- Tax treatment understood

Bonds

- Term sheet finalized

- Legal docs prepared

- Registrar appointed

- Investors onboarded with KYC/AML

- Coupon schedule coded

- Secondary venue arranged

- Ongoing reporting plan in place

Conclusion: Start Small, Build Smart

Tokenization is not about hype; it’s about upgrading how ownership and finance work. For homeowners, it can unlock liquidity. For artists, it can protect royalties. For treasurers, it can streamline bond servicing.

The key lesson? Start small, stay compliant, and think long-term. Pick one asset, learn the process, and measure the real benefits. That’s how individuals and entrepreneurs—not just institutions—can ride the tokenization wave responsibly.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!